The Lifecycle of Developing New In Situ Remediation Chemistries

By: Eliot Cooper

Bringing new technology to market is no easy feat. The technology adoption lifecycle is lengthy, with various stages before a product is embraced by the early majority. Innovators and marketers face the challenge of bridging the gap between early adopters and the early majority to speed up adoption at every stage. In this blog, I’ll explain what it takes to introduce new chemistry solutions for the in situ remediation industry.

For a deeper dive into the application of new in situ injection amendments, check out my on-demand webinar, "How to Decide if a Technology is a Good Bet for your Remediation Project." I was joined by environmental consultant Craig Bruno from Landmark Environmental, and Brad Droy, where we discussed when it makes sense to consider new technology for your site.

What is the Life Cycle of Technology Adoption?

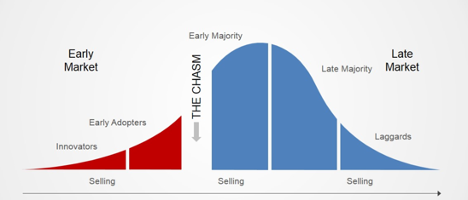

Image source: Crossing the Chasm by Geoffrey A. Moore.

In Crossing the Chasm, Geoffrey A. Moore explains the technology adoption life cycle, which begins with innovators and moves through early adopters, early majority, late majority, and laggards. There's a significant gap between early adopters, who embrace new technology first, and the early majority, who wait until the technology proves its productivity benefits. Innovators and marketers aim to bridge this gap and hasten adoption across all phases. But how does this relate to environmental remediation?

When a new remediation technology is introduced to the market, it undergoes a similar Technology Adoption Life Cycle.

Technology Adoption for Remediation Amendments

New remediation chemistry technologies typically progress through these internal development phases:

-

Identify a Customer Need: Remediation engineers look for solutions to reduce costs, address recalcitrant contaminants (e.g., PFAS), enhance safety, or improve injection and contact methods. Addressing specific remediation challenges is crucial.

-

Identify Competing Chemistries: Define how the new chemistry provides added value over existing ones.

-

Identify the Supply Chain: Determine the necessary supply chain to produce the chemistry.

-

Secure Funding: Obtain funding for initial chemistry development.

-

Develop a “Generation One” Product: Utilize expired intellectual property and evaluate existing patents.

-

Obtain Regulatory Approval: Fulfill requirements like waste discharge permits.

-

Publish Bench Scale Data: Demonstrate lab-scale efficacy and identify any byproducts of concern.

-

Publish Pilot Scale Data: Showcase field efficacy, supported by programs like the DOD’s ESTCP.

- Publish Full-Scale Case Studies: Provide comprehensive case studies.

Early Stages and Market Adoption

Remediation "innovators" are most likely to test new chemistries at their sites. They often seek better results than available chemistries provide and may fund their own bench-scale studies. Innovators also look for competitive advantages over other environmental and engineering consultants.

“Early adopters” transition quickly to pilot testing new chemistries at contaminated sites, developing case studies to support their remediation approaches.

Market adoption can stall at this phase, struggling to move to the “early majority” and “late majority” customers. These groups are pragmatic, risk-averse, and require significant project success and technical data before adopting new chemistries. “Laggards” tend to stick with familiar technologies and avoid risks, potentially losing customers to the “majority” adopters.

Crossing the Chasm

To effectively cross the chasm, chemistry developers need robust sales and marketing strategies to promote their successes and build trust with potential customers. Design support may be necessary since customers might not know how to inject and dose these chemistries. Limited funding can mean relying on association participation, trade show booths, and social media outreach.

The in situ remediation business is event-driven, making it challenging to maintain a steady revenue stream. Remediation projects can take years to move from planning to fieldwork, complicating project timelines.

The Site Characterization-Injection Challenge

Chemistry suppliers often depend on consultants for site characterization and contractors for injection into the subsurface. Success hinges on contact with contaminant mass, and some suppliers may offer these capabilities to better control outcomes. Sharing remediation results with suppliers can aid in improving chemistries and application methods.

Key Takeaways

Achieving “majority” adoption for new chemistries is a slow process but can be expedited with solutions that address remediation needs unmet by traditional chemistries. New chemistries that offer quantifiable regulatory or liability relief will progress through the lifecycle faster.

Sign up for our on-demand webinar, “How to Decide if a Technology is a Good Bet for your Remediation Project,” to hear insights from a chemistry manufacturer, contractor, and consultant about choosing new technologies.

About the Author

Eliot Cooper is the Vice President of Technology and Business Development. In this role, he helps clients design efficient and cost-effective remedies using high-resolution design optimization (HRDO) and a vast array of remediation options. His specialty is finding the right combination of tools and technologies for complex sites and ensuring every step of the remediation process is optimized to achieve results. Most recently Eliot has led the Cascade Chemistries team to bring more cost-effective colloidal solids for PFAS, solvents, and petroleum that are injectable and can get you across the finish line faster.

Eliot draws on a career that spans more than 30 years in the environmental remediation industry and includes hundreds of projects nationwide. He’s remediated sites that involved hex chrome, fuel spills, and chlorinated solvents. He specializes in injected remedy delivery, remediation design support, characterization of VOCs, and tackling complex sites by combining multiple remediation technologies.

Eliot previously served at the Environmental Protection Agency in both air pollution and hazardous waste management programs, as well as in the private sector providing thermal combustion and in situ remediation field services. Eliot now leads Cascade's in situ remediation solutions team to evaluate available technologies to meet client goals, provide advanced delivery techniques, and ensure HRSC results in actionable solutions.